For decades, the message to employers was simple: promoting generic drug utilization will reduce spend to the plan and its participants. While that is still predominantly the case, several marketplace factors have created nuance to that message leading to confusion for patients and plan sponsors. The purpose of this article is to highlight some of these market dynamics and what employers should consider for a pharmacy benefit plan design that drives the lowest net spend.

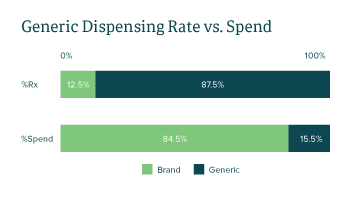

Generic medications are FDA-approved drugs with the same active ingredient(s), mechanism(s), clinical benefits and risks as their branded counterparts. Due to the significantly lower profit margins compared to brands, generic drug manufacturers must rely on a large volume of products sold, novel purchasing alliances and optimizing their drug portfolio to stay competitive for formulary placements. In 2021, generic drugs accounted for approximately 87.5% of medications dispensed, while making up only 15.5% of total spend in the Employers Health book of business.

How the Competitive Landscape Impacts Plan Sponsors

As seen in FIGURE 1, the data validates the narrative that generic drugs account for a fraction of the annual spend despite making up the majority of market share by utilization. Over the years however, brand drug manufacturers have designed strategies to secure market share and compete with generic manufacturers.

- Upon patent expiration and loss of exclusivity, brand manufacturers can provide deeper rebates to drive the brand’s net cost below generic pricing, incentivizing formularies to prioritize brand coverage. This practice has been seen across pharmacy benefit managers (PBMs) and targets products such as Advair Diskus and Adderall XR. To minimize patient confusion, copays for these brand products need to mirror the plan’s generic copay structure.

- While short-term savings of lower net cost brands can be compelling, mass adoption of a brand-over-generic strategy can have serious long-term consequences. Along with already low profit margins for generic manufacturers, shrinking market share can lead to loss of financial viability for the product, unsustainability for the generic manufacturers and decreased long-term competition for expensive brand products.

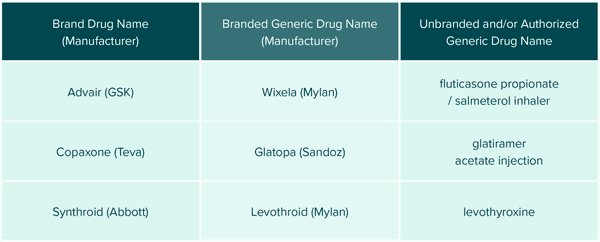

Authorizing generics is another approach brand manufacturers use to gain market share upon loss of exclusivity. Brand manufacturers can create “authorized generics” (AGs), which are identical to the original brand but are sold in different packaging at a lower price. AGs can be manufactured by the innovator company or by a different manufacturer with their permission and often launch just before patent expiration of the branded drug. This practice allows the brand manufacturer to capture and maintain market share before competing generic products launch. AGs are often classified as single-source generics (SSGs) for contracting purposes, so it is important for plan sponsors to understand how SSGs are priced within PBM contracts.

Beyond the market share threats from brand competitors, generic drugs also face price pressure from consolidated buyer groups. Partnerships between wholesalers and distributors have catapulted their purchasing power, placing price pressure on generic manufacturers. In 2017, it was estimated that the top three pharmaceutical distributors (AmerisourceBergen, Cardinal Health and McKesson) captured 92% of market share.

In response to the threats of shrinking market share and downward pricing pressure, generic manufacturers are also designing innovative approaches to remain competitive. Through direct exclusive partnerships with retailers, manufacturers can secure market share and long-term access to patients by creating their own branded versions of generics. Historically, private labeling was done with over-the-counter products that had direct exposure to patients. However, these partnerships have expanded into the prescription market such as the collaboration between Novo Nordisk and Walmart to create the privately labeled generic insulin analog called ReliOn. These partnerships provide manufacturers stable long-term market access while pharmacy retailers benefit from lower cost of goods and product loyalty. In a way, these deals vertically integrate the supply chain leading to higher efficiency and lower costs. The symbiotic relationship from which ReliOn was born helped secure the generic product’s long-term sustainability and ultimately benefited patients, payors, retailers and manufacturers.

Generic manufacturers can also remain competitive by “branding” their generic medications. Products with complex chemical names can be branded by the generic manufacturers to help establish product recognition, “brand” loyalty and simplify communications between patients and prescribers. Branded generics are bioequivalent medications with identical active ingredients but varying inactive compounds and are NOT to be confused with authorized generics which are identical products to the brand. It is simply a marketing strategy that does not mean clinical superiority. See FIGURE 2

Despite pressures from multiple fronts, internal competition among generic manufacturers remains fierce where comparable generic products can have considerable price variations despite insignificant clinical differences between them. Over the last decade, the clinical team at Employers Health has identified numerous multi-source generic products with inflated price tags relative to their therapeutic equivalents. In response, customized programs have been created to protect plan sponsors from exposure to these avoidable costs. Examples of these custom programs are High-cost Generics 3.0 and Expensive Dosage Forms.

High-cost Generics 3.0

Within each therapeutic class, there are often multiple competing products with relatively similar efficacy and safety data. Unfortunately, prices can vary significantly among these comparable products, and the High-cost Generics 3.0 strategy targets two prevalent generics with multiple therapeutic alternatives.

- Rosuvastatin (generic Crestor) is a medication indicated to treat high cholesterol with various competing drugs in the same therapeutic class (e.g., atorvastatin, simvastatin, etc.). Despite being generic with comparable efficacy and safety data, the cost of rosuvastatin remains significantly higher than other generic medications within its class. Due to potency differences between products in the same class, only one strength of rosuvastatin was targeted ensuring clinically appropriate conversion to other statin medications.

- Similarly, esomeprazole (generic Nexium) is an expensive generic medication indicated to treat heartburn. With multiple affordable over-the-counter and prescription alternatives in the same class (e.g., pantoprazole, lansoprazole, omeprazole, etc.), employers can see significant savings by steering members to lower-cost options.

Expensive Dosage Forms

Medications can be packaged in a variety of dosage forms such as tablets, capsules, suspensions, sprays and solutions. Equivalent generic medications regardless of dosage forms are often interchangeable when administered via the same route, yet certain dosage forms are marketed at an excessive cost despite having identical active compounds and no clear clinical advantage. For example, oral tizanidine capsules average about $51 per Rx while the tablet version of tizanidine costs roughly $3 for each prescription. The Expensive Dosage Forms program strategically excludes coverage of specific high-cost formulations of generic products while driving patients to the preferred alternatives via point-of-sale messaging at the pharmacy. Financial performance of this strategy showed plan sponsors who adopted it had an estimated annual savings of $0.13 per member per month, with less than 1% disruption of total eligible members.

Specialty Generics

Compared to traditional markets, specialty drugs have a significantly smaller patient population due to the low prevalence of the disease states. Generic drug manufacturers’ heavy reliance on high utilization volume has historically limited their participation in the specialty space. However, as the prices of branded specialty drugs continue to soar, plan sponsors must collaborate with PBMs, generic manufacturers and even lawmakers to expedite generic entrants and competition in the specialty drug market.

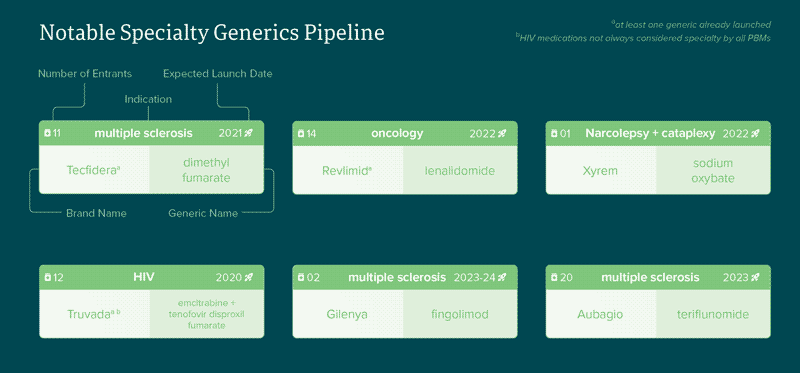

According to our collective pipeline insights, there are over 30 notable generic medications expected to launch in disease states ranging from oncology to multiple sclerosis (MS). Some notable entrants in recent months have been the generics for Tecfidera (MS), Truvada (HIV) and Revlimid (oncology) which led to increased discussion surrounding strategies for specialty generics. Compared to traditional markets, specialty drugs have a significantly smaller patient population due to the low prevalence of the disease states. Generic drug manufacturers’ heavy reliance on high utilization volume has historically limited their participation in the specialty space. However, as the prices of branded specialty drugs continue to soar, plan sponsors must collaborate with PBMs, generic manufacturers and even lawmakers to expedite generic entrants and competition in the specialty drug market. According to our collective pipeline insights, there are over 30 notable generic medications expected to launch in disease states ranging from oncology to multiple sclerosis (MS). Some notable entrants in recent months have been the generics for Tecfidera (MS) and Revlimid (oncology) which has led to some increased focus on this area.

The anticipated lower price tags of specialty generics prompted internal discussions among Employers Health teams regarding new overall effective discount (OED) rates. Discount negotiations of specialty generic effective rates (GER) separated from specialty brand effective rates (BER) will reflect the model in the non-specialty market. This helps plan sponsors more accurately negotiate competitive discounts especially if they

have a particularly high specialty generic dispensing rate. Recent reports show that specialty generics make up about 21.5% of the specialty prescriptions in our book of business. Rolling entry of specialty generic drugs is prompting plan sponsors to review their copay tiering structure. On the non-specialty side, tiered formularies were created to incentivize generics (tier 1), preferred brands (tier 2) and nonpreferred brands (tier 3). Plan sponsors may separate specialty drugs into their own 4th tier with a higher copay or coinsurance to:

- Increase member awareness of the importance and costs of these specialty medications

- Promote good consumer habits by encouraging members to use lower-cost non-specialty items first

- Alleviate cost burden to the plan by partially sharing the cost with members

Today, approximately 40% of Employers Health clients utilize a 4th tier specialty copay structure with an average specialty member cost share at 5% of overall cost. One issue with having only one tier for specialty is that patients do not have a financial incentive to take a specialty generic over a brand. To encourage patients to move to generics and minimize confusion, employers should consider having specialty generic copays mirror that of non-specialty generics. Plan sponsors utilizing specialty copay maximization programs may want to consider a zero-dollar copay for generics to remove the chance of patients paying more than what they did for a brand with coupons that eliminate out-of-pocket costs.

The growth of the specialty generic space and the evolution of the traditional generic drug supply chain highlight the need for employers to regularly review plan designs to encourage efficient plan spend. While the simplicity of generic messaging may be eroding, the opportunities for sound utilization management continue to rise. Collaborating with vendors that fully understand the generic marketplace will help employers from being branded with high spend and trend.

Download Article