It has now been over a decade since the passage of the Biologics Price Competition and Innovation Act (BPCIA) as part of the Affordable Care Act. The intent of the BPCIA is to generate biologic competition by reducing barriers for biosimilars to reach the market.1 The past 18 months have seen quite a bit of movement in the biosimilar space, so we want to provide an update to plan sponsors eager for ways to save on specialty drug spend.

As of this writing, 28 biosimilars have been approved for nine originator products. Only two of these originators have not seen a launch yet, but they just happen to be the most recognizable from a pharmacy benefit standpoint: Humira (adalimumab) and Enbrel (etanercept). Adalimumab biosimilars are expected in 2023, and unfortunately for payers, etanercept is now not expected until 2029 due to the court’s ruling in favor of the originator. The launch prices will be interesting to monitor for these products. The range of Wholesale Acquisition Price (WAC) price difference for recent biosimilar launches is 15% to 37% lower than the originator WAC.2

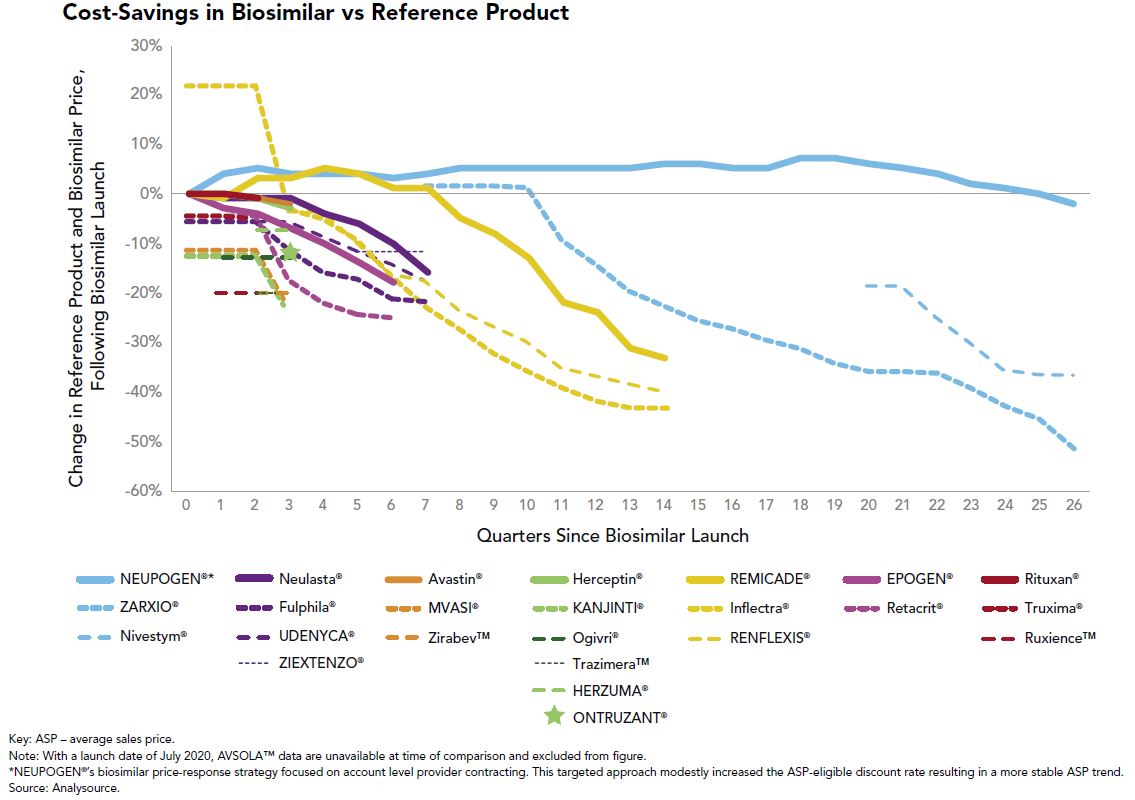

From a good news perspective, the advent of multisource biosimilars has been a welcome sight in the employee benefits community. When only one biosimilar is available to compete with the reference product, the slight financial differences between the two have generally allowed the originator to control formulary preference in favor of “lower” net cost after rebates. That argument gets much tougher to make when multiple biosimilars are launched and price erosion ensues, which is what we are witnessing with Remicade (infliximab), Neulasta (pegfilgrastim) and Herceptin (trastuzumab) to name a few. This price erosion can be seen in Figure 1:

The utilization management tools we use to promote multisource generics on the traditional drug side, such as step therapy and originator exclusions, will be effective strategies to push market share further to biosimilars.

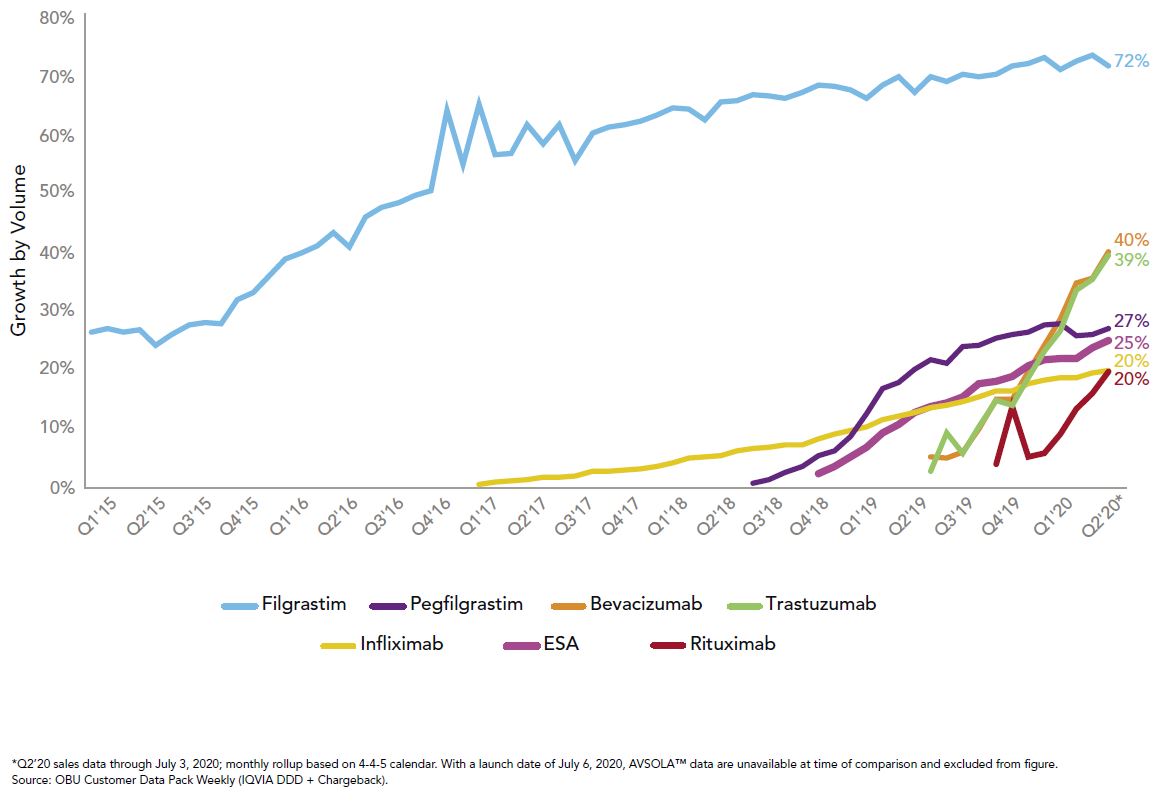

Right now, those tools are being used for the medical benefit products with biosimilar competition as well as recent changes by the Centers for Medicare and Medicaid Services (CMS), which established separate billing codes and biosimilar payment rates. Three of the top 10 drugs of 2019 saw launches of biosimilars, and the uptick in utilization has been much more rapid than their predecessors, as seen in Figure 2:

This rapid growth in uptake combined with the biosimilars pipeline gives great hope for potential savings to the system, which is modeled to exceed $100 billion in total savings over the next five years.3 To reach those savings, it will take all stakeholders to promote biosimilar adoption when possible. We at Employers Health are preparing for ways to hold our pharmacy benefit vendors accountable if originators are still preferred.

For further discussion, please email Matt at [email protected].