As an optional coverage decision, fertility benefits are often excluded in an attempt to minimize health care spend. However, the implications of excluding fertility benefits go beyond the initial perceived cost avoidance.

The definition of infertility is the inability to achieve pregnancy after one year of unprotected intercourse, if not sooner under certain circumstances.1 The prevalence within the U.S. may be underappreciated, as one-in-eight couples, or roughly 15% meet this diagnosis.2 Infertility is a diagnosis many employees may face, and employer backing could drastically improve their journey towards successful treatment. While many factors go into a decision to design or omit a fertility benefit, this article will detail considerations for benefits and human resources teams when designing an ideal fertility benefit plan.

Infertility is a recognized disease state with its own diagnostic ICD codes. Nonetheless, the perception and treatment of infertility as a clinical diagnosis within the self-insured market has been slow to catch on. Recent data suggest that infertility is here to stay, and it is likely growing. Trends within the past few years have shown individuals are electively waiting longer to have children; and with age being the most important factor in determining fertility rates, infertility is becoming more and more common.3 Nationally reported statistics for fertility services, especially in vitro fertilization (IVF), appear to reflect this trend. IVF is one of the most costly and complex forms of assistive reproductive therapy; where the egg and sperm are gathered, fertilized in a laboratory setting and the resulting embryo is transferred into the mother. From 2015-2019, there has been over a 20% increase in these IVF cycles4 with 2019 preliminary data suggesting that more infants are being born through IVF than ever before.

Fertility and the Workplace: HR Advantage? Results from a 2015 national survey found the top reasons to postpone starting a family included being able to focus on a career and child-related expenses.5 This is emphasized with drops in fertility rates in response to widespread financial hardship such as the great depression or the 2008 economic crisis. Proof of how impactful the workplace can be on family planning, whether an employer is aware of it or not; the ability to perform in a career is the most commonly reported reason to postpone starting a family.5 Even indirect employee consequences occur due to managing their health and diagnosis as well as the confusing course of treatment. These concerns are frequently echoed in decision making when seeking new employment.

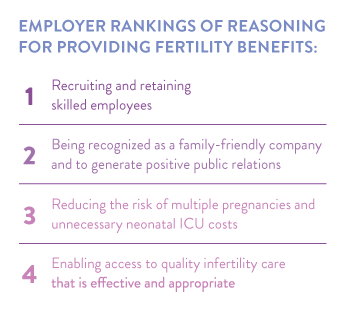

A robust benefits package is a known tactic to sway new hires towards a new employer. The inclusion of fertility benefits is quickly gaining traction within this practice. In fact, 68% of employees are willing to change jobs entirely to obtain this perk.5 These trends are reflected within the 2020 Employers Health Infertility Benefits Benchmarking Survey results, as the two biggest perceived advantages to coverage by those who include it are recruiting and retaining skilled employees and recognition as a family-friendly company.

FIGURE 1

The advantage of using infertility benefits for employee recruitment and retention is especially beneficial for those who have a history of infertility, as reported statistics show the majority feel that infertility is more stressful than traumatic events such as unemployment or divorce.5 In addition, the inclusion of fertility benefits can reinforce company values and support employee loyalty and longevity. This is notably seen in increasingly competitive industries; with many Fortune 500 companies, such as Bank of America and Facebook, providing a fertility benefit. As infertility projections are only expected to increase in the next few years, employee standards for adequate benefits are likely to follow.

Cost versus Clinical Rationale

It is no secret that many fertility treatments can quickly rack up health care spend in the tens of thousands. These costs, however, do not occur within a vacuum. There are many downstream consequences of either the decision to include fertility benefits or not. Perhaps counterintuitively, a growing body of evidence highlights that a robust fertility benefit has the potential to offset medical costs by reducing high-risk pregnancies. Even though IVF cycles are not cheap, inpatient hospital stays, notably those in the neonatal intensive care unit (NICU), can easily exceed the entire cost of a fertility treatment.

With the average cost of IVF ranging by state from $9,000 to $16,000 per cycle, the high cost of IVF can incentivize poor clinical practices that can quickly rack up medical benefit dollars unbeknownst to the payer. If a member is paying for IVF out of pocket, they will be much more inclined to take unnecessary risks such as using more than one embryo at a time for the procedure to statistically increase their chances of conceiving. Even though this may appear to be positive on the surface, pregnancies with twins or more, are innately high risk. Pregnancies with multiples are more likely to be born prematurely or with a low birth weight. These complications can incur almost five times the healthcare costs when compared to all births, and over ten times the cost when compared to uncomplicated births. According to a 2013 study, this contributes to an additional $49,760 per premature or low birth weight newborn on average.6 An employer-sponsored benefit could easily address this by requiring elective single embryo transfers (eSET) when medically appropriate, or by covering multiple IVF cycles, therefore reducing the fear of not conceiving on the first try.

Another IVF option, yet more controversial, can produce a dramatic impact on pharmacy benefit spend as well. The practice of preimplantation genetic testing (PGT) can be added to any IVF treatment. PGT screens embryos for genetic disorders while they are still in a lab before the procedure. Screening can detect over 500 genetic conditions including pharmacy benefit heavy hitters such as cystic fibrosis, spinal muscular atrophy and hemophilia. Though the potential benefit can be substantial, PGT is not required within an IVF regimen. So if costs are directing the course of treatment, PGT may never be considered. Even with these factors playing a role, only one-third of fertility-covering respondents in our survey reported including PGT services. For employers, providing PGT coverage may be beneficial in the long term for the plan as well as their members.

Employers Health Infertility Study Results A fertility coverage survey was distributed at the end of 2020 providing insight into fertility practices currently utilized within our coalition. Questions explored fertility trends, services provided and different opinions and management strategies endorsed by clients. A subsequent data pull was conducted comparing utilization trends based upon survey responses. Within the survey responses received, roughly half included fertility benefits within their plan. Of those covering fertility, the most common management strategy was through lifetime monetary caps limiting employer contributions. The amounts of these caps varied significantly between plan sponsors, starting at $750 and going up to $60,000, with the average falling around $25,000 per member. Interestingly, around 30% of respondents reported no restrictions managing coverage. This is a perfect example of how there is no one-sizefits-all fertility benefit.

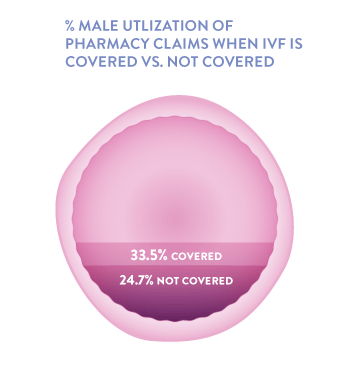

FIGURE 2

Utilization metrics were compared between two groups, those who cover IVF and those who do not. A poignant finding was plans that cover IVF had much more male utilization of products than those who did not (34% versus 25%). Since approximately 40% of infertile couples have a male factor as the sole or contributing cause of infertility, this difference can be meaningful. The suggestion that IVF coverage may encourage more male treatment is substantial, as assessing and treating both partners is imperative for success FIGURE 2.

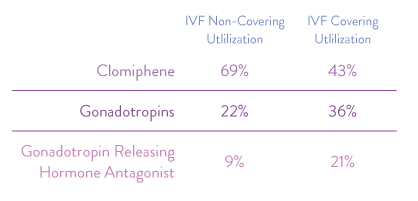

In addition, IVF covering clients had 26% less utilization of the oral infertility medication clomiphene. This is notable as the manufacturer labeling reports 8% of all clomipheneinduced births are multiples, with no way to mitigate that risk. Providing coverage of more advanced treatments, such as IVF, appears to reduce the utilization of clomiphene and its subsequent multiple-birth rate.

FIGURE 3

Overall, the quality of fertility treatments have drastically improved in the past 20 years. It is time that insurers take advantage of the industry’s progression and encourage the use of these increasingly safe and effective treatments.

In conclusion, even providing a minimal fertility benefit can make a major difference among employee satisfaction, recruitment and retention. This impact is likely to grow in the future as infertility rates continue to rise. Before deciding on fertility benefits, consider requesting medical benefit data for the health plan. Inconspicuous medical spend for childbirth and neonatal care may come to light and drastically influence the financial appraisal of the benefit. Ultimately, ensure that elections are well-informed and reflect on population parameters such as average member age, employee turnover rate and total lives covered. An effectively designed plan can direct members towards high-quality care while tailoring cost management strategies to the appetite of the plan sponsor.

Download Article